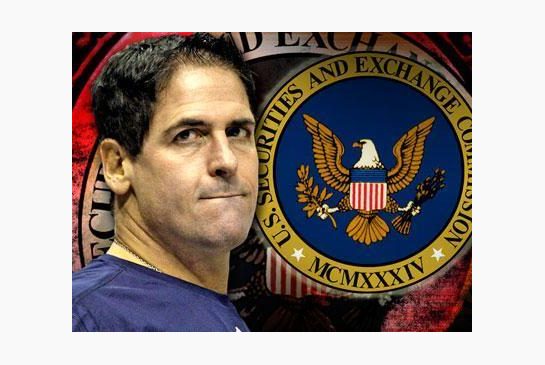

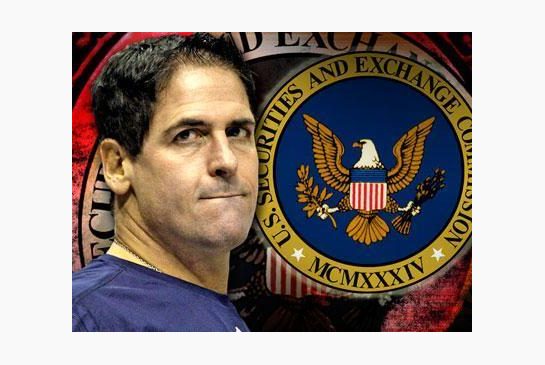

30 Sep Mark Cuban Back in Court with the SEC on Insider Trading

Billionaire, “Shark Tank” star and pro basketball impresario Mark Cuban is bringing a little Hollywood celebrity to the drab world of insider trading. The SEC believes he illegally traded stock in Momma.com back in 2004 based on nonpublic information. The case was thrown out in 2009 but reinstated by an appeals court. The trial starts today in Dallas. It’s not about the money, only $2 million at stake for the super-rich Cuban. This is a civil, not criminal matter.

Billionaire, “Shark Tank” star and pro basketball impresario Mark Cuban is bringing a little Hollywood celebrity to the drab world of insider trading. The SEC believes he illegally traded stock in Momma.com back in 2004 based on nonpublic information. The case was thrown out in 2009 but reinstated by an appeals court. The trial starts today in Dallas. It’s not about the money, only $2 million at stake for the super-rich Cuban. This is a civil, not criminal matter.

There are some factual problems with the case, so it appears. The company did tell Cuban about a private offering it was planning. They knew Cuban wouldn’t like it but told him about it as a guy who was accumulating a bunch of stock in the company. The CEO later claimed he got Cuban to agree to keep the information confidential. Cuban doesn’t recall the conversation. But the CEO did not ask him to refrain from trading on the information. Because he didn’t, the lower court threw out the case. The higher court disagreed and sent it back for trial. But the SEC will, at a minimum, have to prove that he agreed to keep the information confidential, which itself may not be easy.

I’m no expert on the law of insider trading. But many people scratched their heads when they heard that a court said it’s ok to trade in a stock (Cuban dumped all his stock immediately after the call and saved about $750,000 in losses) if you get material nonpublic information and agree to keep it confidential but don’t agree to refrain from trading. And shouldn’t it logically be enough if the person receiving information knows or should know that the information is not public? We will see how the courts rule. What do you think?

No Comments