24 Jun House Bill Exempts Private Equity Advisors from SEC Registration

As we know, the Dodd-Frank Act required advisors to larger private equity and hedge funds to register with the SEC. The real focus of this was on hedge fund advisors, to bring them out of the shadows and let the SEC know what they are up to after a number of insider trading and alleged investor fraud situations. Registering as an investment advisor is not particularly burdensome, but it lets the public know you are there. The venture community’s lobby managed to get themselves exempt from this when the bill was passed.

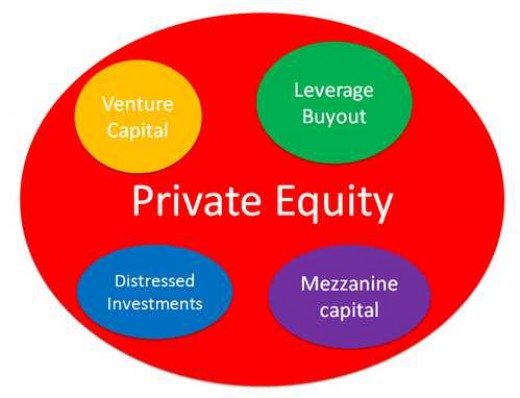

Now the private equity guys have convinced the House Financial Services Committee to approve, by a vote of 38-18, a bill to also exempt private equity fund advisors from registration. Eight Democrats supported HR 1105. That gives it a fighting chance in the Senate, assuming the House’s Republican majority is likely to approve. But which private equity firms will be exempt? Who is a private equity fund anyway? The bill deftly leaves to the SEC to define who are private equity advisors that will not have to register. The bill passed the committee despite a letter from SEC Chair Mary Jo White opposing it.

We have not heard about major scandals or legal issues with traditional private equity firms of the size that would be required to register, so this seems like a logical and reasonable step. To encourage more and more fund advisors to leave this country (as some have) because of burdensome regulation doesn’t seem to make sense for anyone. So hopefully this one gets through.

No Comments