20 Jan State Crowdfunding Surges Ahead

Let’s give one to the states. Often in their attempt to regulate securities offerings we find states a source of delay and frustration. However, given the snail’s pace at which the SEC is implementing crowdfunding rules mandated by the Jumpstart our Business Startups (JOBS) Act of 2012, many states are jumping ahead and passing their own crowdfunding laws.

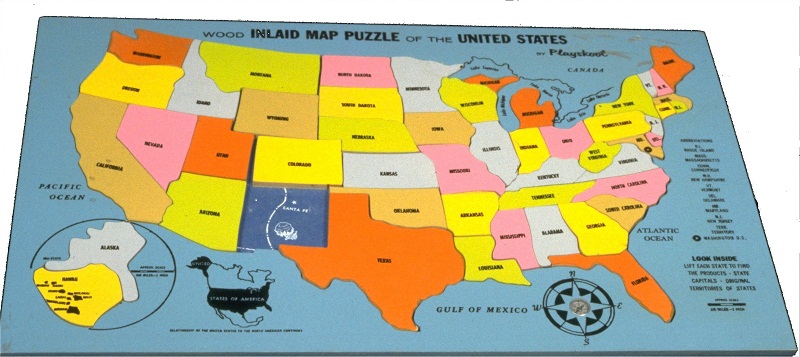

Congress and the SEC have recognized that offerings taking place wholly within a state by a company located there can be done under state regulation, exempt from all federal oversight. This “intrastate exemption” has been used as a basis for these new local crowdfunding rules.

So now 13 states have passed laws and another 14 are in the process of doing so. Some allow you to raise up to $1 million, others up to $2 million. Some don’t require audited financial information for smaller offerings, some do. There do not seem to be requirements of a “portal” or broker-dealer to be involved as mandated by the JOBS Act at the federal level. It’s all turning into an interesting experiment as to what will and won’t work.

Let’s keep an eye on this!!

No Comments