19 Oct Remembering (the Second) Black Monday

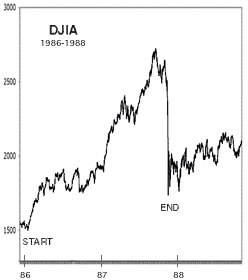

Thirty years ago today, October 19, 1987, the Dow Jones Industrial Average crashed with a whopping 22.6% decline in prices, the second biggest one day drop in the market (the biggest was in 1914). I was a young lawyer working at a large law firm at the time. Young enough that I had no real money invested in the market. My office-mate, however, another young lawyer, was from a wealthy family and was a very active market investor. Hard to imagine, but at the time the only way to get stocks traded was to call your broker. No online capability then.

The one problem my office-mate had: he couldn’t get through to his broker to try to sell a bunch of his holdings during the selling frenzy. Incredibly frustrated, he finally gave up and accepted his fate. What did he do after sleeping on it a few days later? Finally reached his broker and calmly started buying up all the stocks he liked at their now 20% or more discount to where he was a few days earlier. Of course the bet paid off as roughly six months later the markets had returned to their pre-crash levels.

The first Black Monday? That anniversary also looms. On Monday, October 28, 1929, the Great Crash, which had started the previous Thursday, was reaching a crescendo which basically ended the following day, Black Tuesday. Of course this dove the country into the Great Depression and the suffering and economic upheaval endured by so many. As we now enjoy a very long and successful bull market with record highs almost daily, let’s remember one thing that will always be true. The markets go up. Then they go down. Rinse and repeat. The only thing we can’t predict: when and how much. The other thing: the markets almost always outperform pretty much any other investment opportunity over the long term.

No Comments