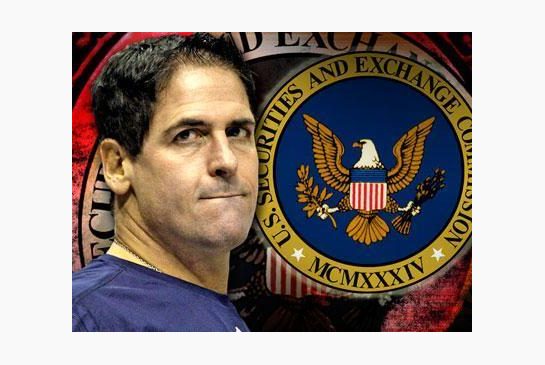

Mark Cuban Back in Court with the SEC on Insider Trading

Billionaire, "Shark Tank" star and pro basketball impresario Mark Cuban is bringing a little Hollywood celebrity to the drab world of insider trading. The SEC believes he illegally traded stock in Momma.com back in 2004 based on nonpublic information. The case was thrown out in...